BOKS International member firm, Değer SMMM, has produced the following guide to tax incentives in Turkey.

A. Skilled and Cost Competitive Labour Force

B. Liberal Investment Climate

C. Lucrative Incentives

D. Advantageous R&D Ecosystem

E. Strategic Location

A. Skilled and Cost Competitive Labor Force

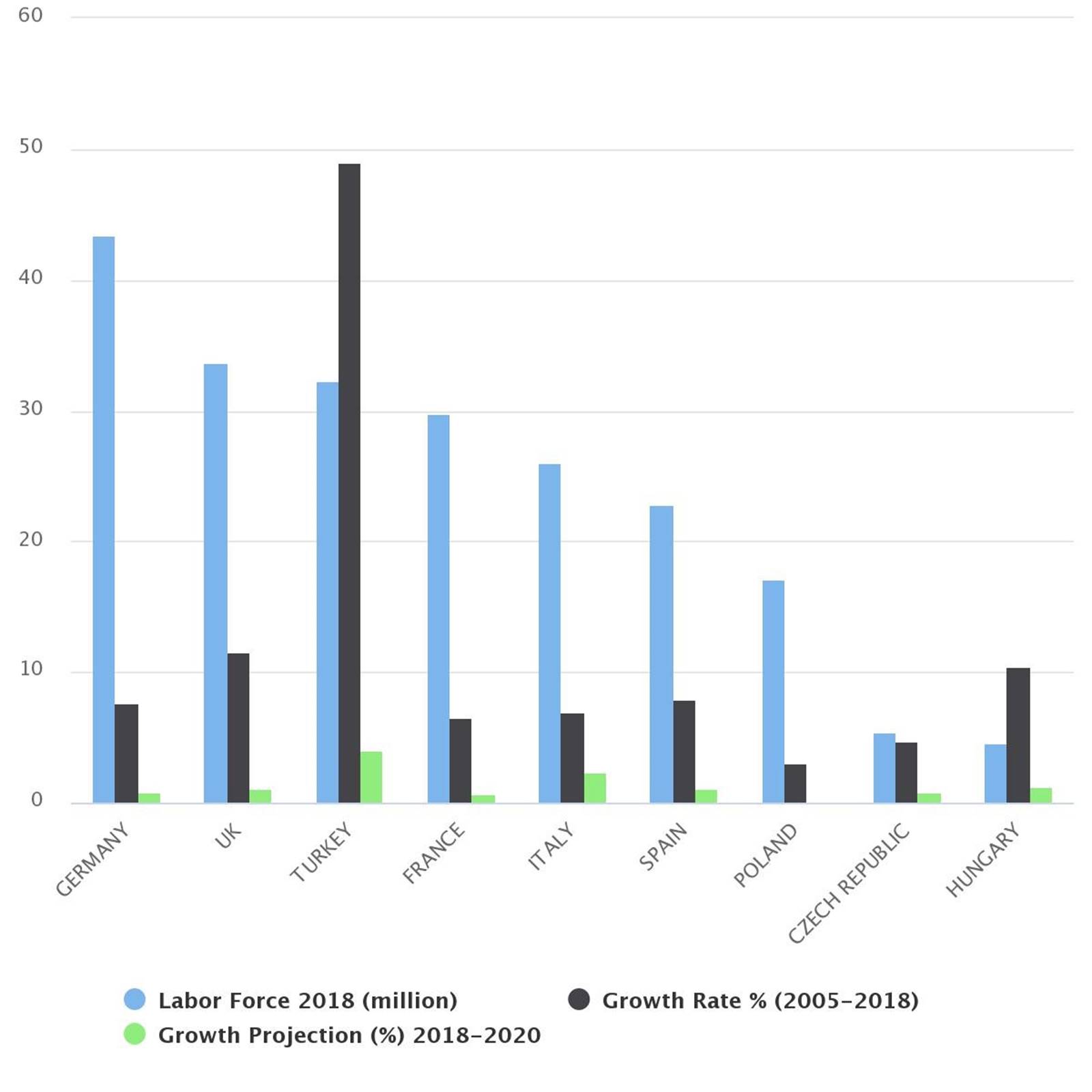

With a population of 83 million people, Turkey offers a labour force of 33 million citizens which makes the country the 3rd largest labour force in Europe.

Turkey’s young population is an important contributor to labour force growth and has boosted the country’s rank over peer countries. Turkey has posted the largest labour force growth among the EU countries.

The labour costs are comparatively lower than other European countries. Below, you can find details regarding to announced minimum wage in 2021.

| For the year 2021 | Turkish Lira | EUR* |

| Gross Wage | 3.577,50 | 397,15 |

| Employee’s national health insurance contribution | 500,85 | 55,60 |

| Employee’s Unemployment Premium | 35,78 | 3,97 |

| Income Tax Base | 3.040,87 | 337,58 |

| Income Tax | 456,13 | 50,64 |

| Min. living allowance (-) | 268,31 | 29,79 |

| Income tax after min. Living allowance deduction | 187,82 | 20,85 |

| Stamp Tax | 27,15 | 3,01 |

| Total Deduction | 751,6 | 83,44 |

| Net Wage | 2.825,90 | 313,71 |

| Gross Wage | 3.577,50 | 397,15 |

| Employer’s national health insurance contribution (% 15,5) | 554,51 | 61,56 |

| Employer’s Unemployment Premium (%2) | 71,55 | 7,94 |

| Employer’s Total Cost for Min. Wage | 4.203,56 | 466,65 |

| * Converted by 31.12.2020 T.C. Central Bank EUR/TL Rate | ||

B. Liberal Investment Climate

Turkey’s investment legislation is simple and complies with international standards while offering equal treatment for all investors.

The fundamental parts of the overall investment legislation include the Encouragement of Investments and Employment Law No. 5084, Foreign Direct Investment (FDI) Law No. 4875, the Regulation on the Implementation of the Foreign Direct Investment Law, multilateral and bilateral investment treaties, and various laws and related sub-regulations on the promotion of sectoral investments.

The FDI Law provides a definition of foreign investors and foreign direct investments. In addition, it explains important principles of FDI, such as freedom to invest, national treatment, expropriation and nationalization, freedom of transfer, national and international arbitration and alternative dispute settlement methods, valuation of non-cash capital, employment of foreign personnel, and liaison offices.

Turkey has signed Double Taxation Prevention Treaties with 85 countries and Social Security Agreements with30 countries.

C. Lucrative Incentives

Applicable both for greenfield and brownfield projects, Turkey offers a comprehensive investment incentives program with a wide range of instruments that helps to minimize the upfront cost burden and accelerate the returns on investments.

These incentives may also be tailored for projects in priority sectors classified as key areas for the transfer of technology and economic development. In addition, the Turkish government provides generous support programs for R&D and innovation projects, employee training initiatives, and for exporters through various grants, incentives, and loans.

General Investment Incentives:

Tax exemption for procurement of machinery and equipment, regardless of the investment region.

– VAT Exemption

– Customs Duty Exemption

Regional Investment Incentives:

Higher incentives for investments to be made in less developed regions. (including Priority Investment Incentives that offer incentives regardless of the investment region for manufacturing of medium-high tech and high-tech products)

– VAT is not payable for machinery and equipment to be purchased.

– Customs duty is not payable for machinery and equipment to be supplied from abroad.

– Corporate tax is paid with reduction.

– The employer’s share of the social security premium calculated for employment will be covered by the government.

– The employer’s share of the social security premium calculated on the basis of the legal minimum wage for employment will be covered by the government.

– The income tax determined for the employment will be exempt.

– A certain portion of the interest to be paid for loans obtained will be covered by the government.

– Land is allocated for investment based on the availability, in accordance with the principles and procedures set by the Ministry of Environment and Urbanization.

– VAT refund is provided for building and construction expenditures.

– No property tax is payable for land and buildings.

Export Incentives

There are export support instruments by the Ministry of Trade, which includes tax exemptions and cash supports in order to increase Turkey’s exports. Free Zones offer tax benefits, especially for export-oriented investments.

– VAT is not payable for machinery and equipment to be purchased.

– Customs duty is not payable for machinery and equipment to be supplied from abroad.

– Eligible expenditures are partially rebated by the institution providing support after the expenditures are paid.

– The income tax determined for the employment will be exempt.

– No corporate tax is payable.

– Enterprises in free zones are exempt from special consumption tax.

– No property tax is payable for land and buildings.• No stamp duty is payable for documents.

– Credit opportunities with reduced rates are provided to investors to import exportation.

D. Advantageous R&D Ecosystem

Extensive R&D incentives in Turkey are further supported by the well-educated and highly qualified labour force, competitive cost advantages, and several global companies that are active in the market. Altogether these form a dynamic ecosystem in Turkey.

a. Tax benefits for R&D and design centres:

– Customs duty is not payable for machinery and equipment to be supplied from abroad.

– The employer’s share of the social security premium calculated for employment will be covered by the government.

– The income tax determined for the employment will be exempt.

– R&D and design expenditures are wholly deductible from the corporate tax base.

– No stamp duty is payable for documents.

b. Tax benefits for companies that are located in Technoparks:

– VAT is not payable for machinery and equipment to be purchased.

– Customs duty is not payable for machinery and equipment to be supplied from abroad.

– The employer’s share of the social security premium calculated for employment will be covered by the government.

– The income tax determined for the employment will be exempt.

– No corporate tax is payable.

– No stamp duty is payable for documents.

In addition to tax benefits, The Scientific and Technological Research Council of Turkey (TUBITAK) provides grant opportunities for research, technology development, and innovation activities. Eligible expenditures are partially rebated by the institution providing support after the expenditures are paid.

E. Strategic Location

Turkey is a natural bridge between both the East-West and the North-South axes, thus creating an efficient and cost-effective hub to major markets. The country offers easy access to 1.5 billion people and a combined market worth of USD 24 trillion GDP in Europe, MENA, and Central Asia within a 4-hour flight radius.

Turkey’s strategic location enables easy reach to markets across 16 different time zones, from Tokyo to New York. Turkish Airlines connects 255 destinations in 122 countries.

There is also income tax withholding support and stamp duty exemption for international companies that open or move their regional management centres to Turkey.

If you need any further information on scope of tax incentives in Turkey, please contact with Alper Çaltekin ([email protected]) from Değer SMMM / TURKEY.

Resource: The Investment Office of the Republic of Turkey / www.invest.gov.tr